Heloc amount determined

Or skip doing the math and use the HELOC calculator below to see how. PNC is also offering 150 cash for applicants of its Choice HELOC through August 31 2022 if the line amount is at least 75000 and certain terms and closing deadlines are met.

Lighten Up Your Home With Summer Decor In Aug 2022 Ourfamilyworld Com Summer Decor Decorating On A Budget Room Ideas Aesthetic

Find answers to questions important forms and additional methods to contact us.

. Here are some of the most common HELOC eligibility requirements. In effect you make an extra monthly payment each year. Was denied at a later stage was determined later to be incomplete or was approved but not accepted.

If you want a low HELOC rate Credit Union HELOC rates from Mission Fed can help. 15-20 equity in home is the norm. The amount of equity you can cash out depends on the current value of your home and your existing loan balance.

Your equity in the house is its appraised value minus the unpaid mortgage amount. Fifth Third Bank does not charge closing costs a potential cost-savings advantage. A home equity line of credit or HELOC ˈ h iː ˌ l ɒ k HEE-lok is a loan in which the lender agrees to lend a maximum amount within an agreed period called a term where the collateral is the borrowers equity in their house akin to a second mortgageBecause a home often is a consumers most valuable asset many homeowners use home equity credit lines only for.

Pay off more high-interest debt. Heres how the average interest rate breaks down based on the loan-to-value ratio. Your credit score and debt-to-income ratio also play a role in calculating your HELOC amount.

A HELOC margin is a set amount added to. Banks see a HELOC with a loan-to-value ratio over 80 as a bigger risk. Mission Fed is proud to offer benefits such as lower interest rates and fewer fees on Home Equity Lines of Credit to help you keep your costs down.

A HELOC draw period is the amount of time you have to tap into that available credit. Receive assistance from our customer support center. Personal Home Equity Solutions Home Equity Line of Credit HELOC.

Where are you located. Many banks set their prime rates based on the federal funds rate targets established by the Federal Reserve though this makes them more volatile especially in rising rate environments. Investment property cash-out loans have a maximum loan-to-value ratio LTV of 25.

The amount of money that can be borrowed is determined based on several financial factors that well explain below. 350000 - 200000 150000. Lets take a closer look at some of these items.

Pros Borrowing limit up to 90 CLTV. The official staff commentary to Regulation C states that a lender who opts to report a HELOC should report in the loan amount field only the portion of the line intended for home improvement or home purchase. Make more home renovations.

Unison uses a 25 risk adjustment which lowers the starting value of your home and increases your cost. HELOC Payments How are HELOC repayments structured. The HELOC repayment is structured in two phases.

The banks lenders and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews. The amount of equity you have in your home is determined by the value of your home minus the amount you owe on your mortgage. For example if your home is valued at 300000 and you have a 150000 balance on your mortgage you have 150000 in equity.

A HELOC is similar to a credit card because you can withdraw funds up to your limit. Your HELOC limit can be determined using the loan to value LTV ratio and remaining mortgage balance. The minimum HELOC amount that can be converted at account opening into a Fixed-Rate Loan Option is 5000 and the maximum amount that can be converted is limited to 90 of the maximum line amount.

Over the course of a year youll make 26 biweekly payments which would total the amount of 13 monthly payments. They offer HELOCs starting at a 199 APR for the first 12 months and then a 45 to 84 rate thereafter. Generally banks charge more for those loans.

Up to 95 LTV with a HELOC Combo Calculate your available funds. Your credit qualifications amount of the line of credit Loan-to-Value LTV ratio and type of property. Still its much lower than the risk adjustment of its competitor Point which can be as high as 25.

Subtract the amount you still owe on your mortgage 200000 to get the total amount you can borrow with a HELOC 55000. Most HELOC rates are tied to the prime rate a variable interest rate thats determined by individual banks. Lenders typically limit loan amounts to 75 to 80 of your total equity.

Lender APR Introductory APR Line Amount Range HELOC Terms Max LTV. Eligibility will be determined three or more business days after the requirements are satisfied. If you have below average credit expect to pay rates closer to 9 to 10.

PNC only offers a HELOC for home equity with interest rates from 225 to 24 and no minimum draw amount. The minimum loan term is 1 year and the maximum. Your credit line caps at 899 of your homes equity depending on the state where you live and you can draw on your account for 10 years paying interest-only payments then add principal to repay the loan in full over the next 20 years.

Alliants high borrowing limit makes it an ideal choice for borrowers who need to access a large amount of funds or who havent built up a lot of equity yet. Since your home is valued at 250000 80 of that is 200000. Unisons 500000 maximum cash amount is much higher than its competitors maximums.

If the collateral is determined to be in an area having special flood hazards flood insurance will be. Our regular HELOC has a fixed rate for the first 12 months then a variable rate for the rest of the term. You typically cannot get a home equity loan or HELOC for the full amount of your equity in the house.

15000 to 750000 up to 1 million for properties in California. After you subtract your mortgage balance of 150000 your potential HELOC amount is 50000. At the same time the rate on a 20-year HELOC is 736 up 21 basis points from.

Maximum cash amount. Offer pros and cons are determined by our editorial team based on independent research. If you have good or excellent credit you could lock in a lower HELOC rate closer to 3 to 5.

Neither code 7 preapproval. The draw period is the phase. A home equity line of credit HELOC allows homeowners to borrow funds based on the equity they own in the home.

We Buy Houses Real Estate Investor Essential T Shirt By Noirty We Buy Houses Home Buying Real Estate Investor

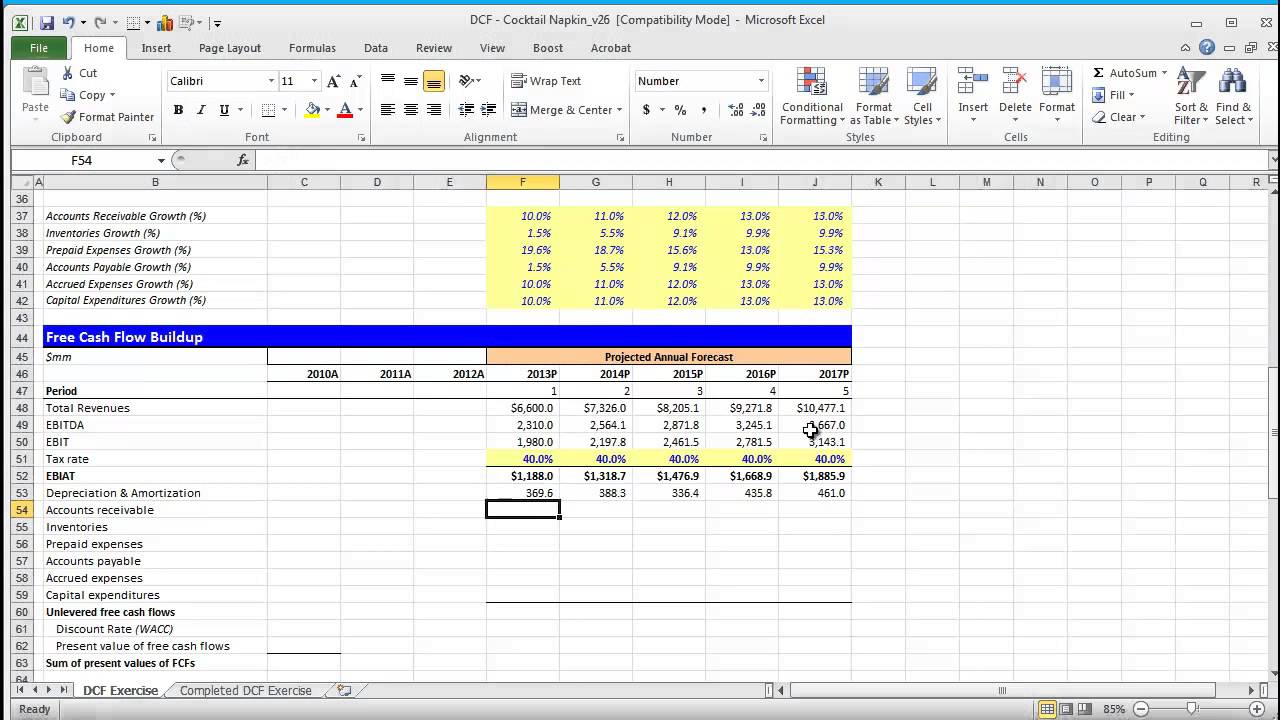

Financial Modeling Quick Lesson Building A Discounted Cash Flow Dcf Model Part 1 Financial Modeling Cash Flow Financial

Financial Modeling Quick Lesson Building A Discounted Cash Flow Dcf Model Part 1 Financial Modeling Cash Flow Financial

What Is A Home Equity Line Of Credit Heloc How Does It Work Line Of Credit Home Equity Heloc

Heloc Infographic Heloc Commerce Bank Mortgage Advice